Term Deposit Plans

A Term deposit is a product offered by banks that provide interest rate in exchange for customers agreeing to leave a lump-sum of money with the bank for a fixed period or term. There are various types of Term deposits. For example, Certificate of Deposit.

The Term deposits can have single or multiple plans. A plan is a combination of a period or term and a deposit amount, and for these combinations, the bank can offer different interest rates.

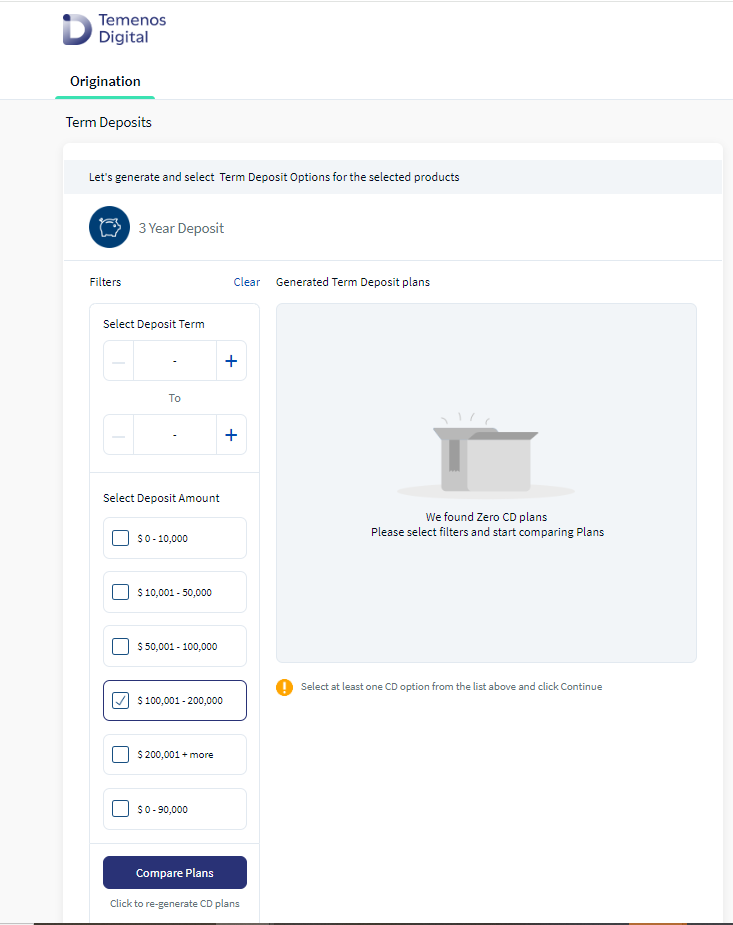

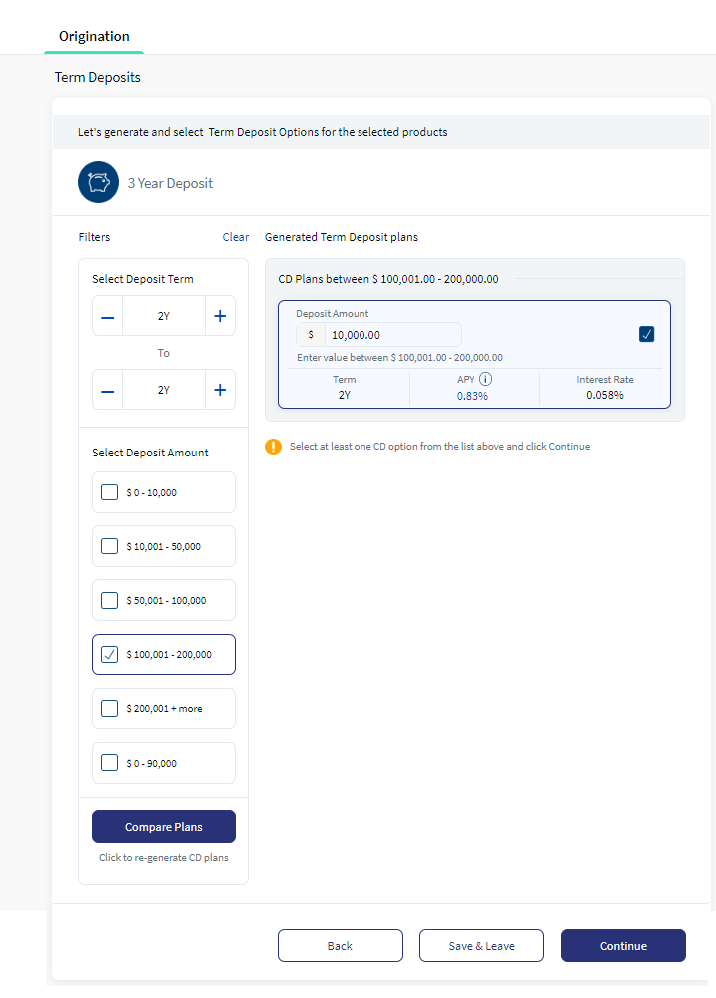

You can select a plan based on your requirement. The Term Deposit Simulation feature helps you to compare different plans available on the selected product. It filters the appropriate plans based on the deposit term range and deposit amount you select. The capability to compare different plans is a unique feature of the Origination app when compared to other solutions on the market.

If the Term deposit product that you select has a single plan, the simulation feature is not applicable. In this case, you can directly select the plan, and then click Continue.

As users can select more than one Term deposit Product, you can navigate between the Term Deposits Simulation for each Product on the app. You can navigate through different Term deposit products by clicking on the appropriate product icon from the Select Term Products section. You can select one or more plans for all of these products.

UX Overview

This section provides an overview of the Term Deposits section in the Product Selection module.

The Term Deposits section contains the following segments:

- Selected Term Deposit Products: This section contains the Term Deposit products that you have selected.

- Generated Term Deposit Plans: This section contains the appropriate plans based on the range of deposit term and deposit amount you selected for each of the selected Term Deposit products.

There are 2 possibilities for Term Deposit plans, depending on the Term Deposit product you selected:- Single Term Deposit Plan: In this case, you must confirm the selection and provide the Deposit Amount.

- Multiple Term Deposit Plans: In this case, you have the capability to compare different terms and amounts and select any desired plan. You can select as many plans as you desire to.

- Filters: This section contains the Deposit term and the Deposit amount fields which you can use to generate the plans in the desired range.

- The Filters section appears only if multiple Term deposit plans are available for the selected product.

- The upper limit values in the Deposit amount ranges are retrieved from the Marketing Catalog Microservice. The last deposit amount range in the section, for example, 100000 + more does not have a fixed upper limit value. The upper limit value that is retrieved for this range is R (REST). In this case, after selecting the plan, you can enter any deposit amount that is greater than the lower limit value.

Follow these steps to select the Term deposit plans:

- In the Filters section, select the Deposit Term range.

Ensure that the From value you enter is less than or equal to the To value, otherwise, the app displays an error message.

- Select the range of the Deposit Amount. You can select more than one range of deposit amounts.

- Click Compare Plans.

The applicable list of plans appear in the Generated Term Deposit plans section. Every plan displays basic information such as Term, APY, and Interest Rate.After clicking on Compare Plans, if you want to add a new range of deposit amount or a deposit term range, ensure that you re-compare the plans, that is, click on Compare Plans again.

- Select the desired plan, and then type the fixed deposit amount in the selected range.

- Depending on the number of the term deposit products that you have selected, follow either of these steps:

- If you have selected only one term deposit product, click Continue.

- If you have selected multiple products, choose the other products from the Selected Term Deposit Products section. After you select the products, choose the required plans, and then click Continue.

The Confirm Term Deposit Plans window appears.

If you have entered a deposit amount value that is not in the selected range, and then click Continue, the app displays a red dot on the respective product. When you click the product, the app displays the error above the Select Deposit Range field.

- On the Confirm Term Deposit Plans window, click Yes.The Feature Selection page appears.

The Term Deposit plans have been saved.

Components

The Term Deposits section in the Product Selection module contains the following list of components:

| Component Name | Instance Name |

|---|---|

| com.nuo.Roadmap | Roadmap |

| com.dbx.popup | backConfirmationPopup |

| com.dbx.bannerError | bannerError |

| com.dbx.popup | comparePopup |

| com.dbx.popup | continuePopup |

| com.dbx.customheaderNUOV2 | customheaderNUOV2 |

| com.dbx.customfooter | customfooter |

| com.dbx.filterResults | filterResults |

| com.dbx.filtersSheet | filtersSheet |

| com.dbx.filtersSheet | filtersSheetDW |

| com.nuo.loadingV2 | loadingV2 |

| com.nuo.loadingV3 | loadingV3 |

| com.dbx.navButtons | navButtons |

| com.dbx.rangeStepper | rangeStepper |

| com.dbx.popup | saveAndLeavePopup |

| com.dbx.popup | signoutPopup |

Experience APIs

The following APIs are shipped as part of this feature:

| API | Description |

|---|---|

| getAllCDPlans | This API fetches all the Term deposit plans for the selected product. |

Configurations

If you want to configure the Term deposit plans for any Term deposit product, you can use the Postman tool. To download the postman collection, click here. To understand the field mapping in the MCMS for each element in the Term Deposits section, refer to Field Mapping and Reference Data.

Extensibility

By using the Extensibility feature, you can customize the modules based on your requirements. For more information, refer to Extensibility.

In this topic